Buy Genus Power As Its Going For New High

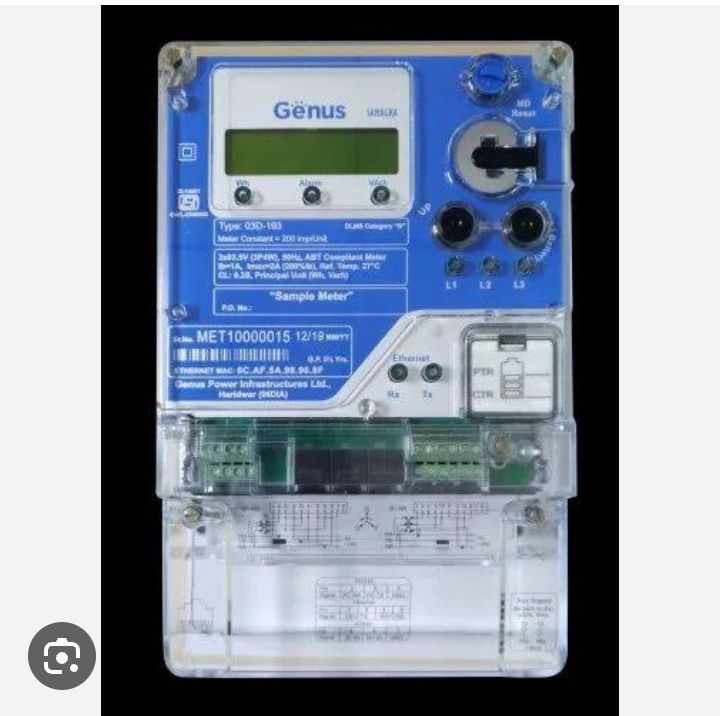

Buy Genus Power : Genus power is at its 52 week high. GIC is taking 74% stake in this company. The function of the company is producing Electric Meter. Shareholding Pattern - Promoters 50.43% FII. 2.33% DII. 5.24% Public. 42.00% Total income is 180cr. Total Expenditure is 179cr. Net Profit is -22Cr. Reserve is 957cr. 3 year CAGR sales is -12% from -19%. CAGR profit is -36% from +8% Debt to Equity is 0.35 As if GIC is buying it, the shares seems best for long term investments.